Margin of USDT-margined Contract

- Guides pour les Futures USDT-M

In a digital asset derivatives market, users can join derivatives trading by paying a certain percentage of assets based on the contract price as the financial guarantee for the performance of the contract. Such assets are the margin required for contract trading. After a position is opened, the margin required for holding the position in the derivatives account will change with the last price.

Isolated margin mode:

Each pair has a separate account, that is, isolated margin account. The margin for various types of contract and various trading pairs is calculated separately. Such data as PnL, occupied margin and margin ratio of each pair will not affect each other.

For example, Tom holds a position of BTC/USDT swaps and a position of ETH/USDT swaps in the isolated margin account at the same time. If the margin ratio of BTC/USDT swaps is equal to or less than 0% and liquidation will be triggered, then there will be no assets in this isolated account. At this time, the isolated position of ETH/USDT swaps could be held continually without any impact.

Cross margin mode:

All USDT-margined contracts under the cross margin mode share the USDT in the cross margin account as the margin, which indicates that all positions of USDT-margined swaps and USDT-margined futures under the cross margin mode share the same account equity, and their PnL, occupied margin and margin ratio are calculated jointly.

Assume Jack holds a position of BTC/USDT swaps, ETH/USDT swaps and BTC/USDT weekly futures separately in the cross margin account. Then the USDT assets in the cross margin account will be the margin for these three contracts. The margin ratio of these three contracts is calculated jointly as well. Therefore, when the margin ratio of the cross margin account is equal to or less than 0 %, liquidation maybe be triggered for the positions of these three contracts in the cross margin account.

Please Note: USDT-margined swaps support both cross margin and isolated margin mode at the same time. The margin for these two kinds of account is calculated separately. While USDT-margined futures only support cross margin mode. Under the cross margin mode, USDT-margined swaps share the same margin in the cross margin account with USDT-margined futures.

Calculation:

Position Margin = Face Value * Position Amount* Last Price / Leverage

Example 1: Tom buys 100 conts BTC/USDT contract (face value = 0.001 BTC/cont) to open a long position, the last price is 5,000 USDT and the leverage is 10x. According to the formula, the position margin= 0.001 * 100 * 5,000 / 10 = 50 USDT

Example 2: Tom buys 100 conts ETH/USDT contract (face value= 0.01 ETH/cont) to open a long position, the last price is 500 USDT and the leverage is 10x. According to the formula, the position margin= 0.01 * 100 * 500 / 10 = 50 USDT

Rules for Tiered Margin

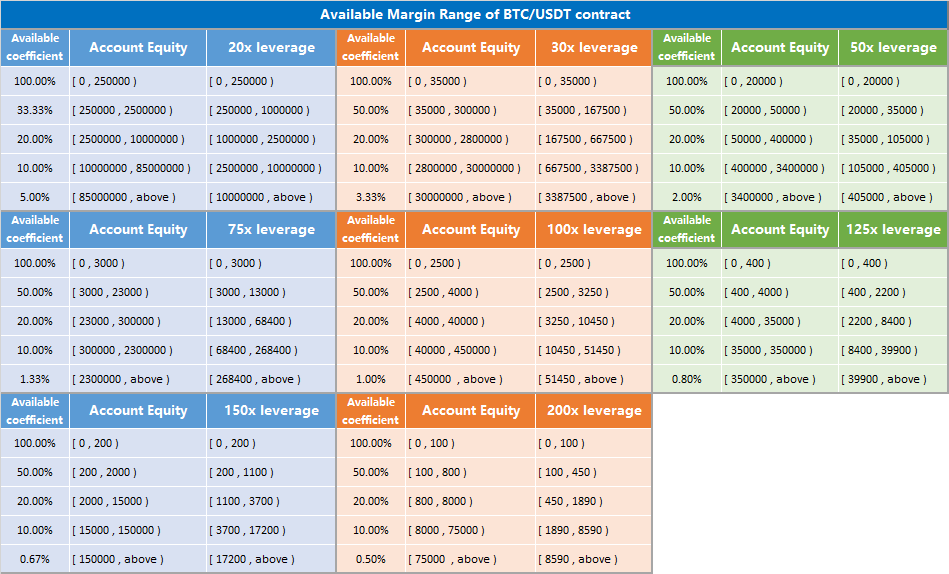

In order to maintain the stability of the Derivatives market and reduce the risks of large positions, HTX Futures adopts a Tiered Margin system, as the available margin will be adjusted according to account equity and leverage. When the account equity corresponding to the leverage used by the user exceeds a certain range, the margin available to open a position will be increased/decreased; Tiered margin limits vary by the type of contract and trading pair, and the available margin range of the isolated margin account is the same as that of the cross margin account, but the available margin for USDT-margined futures with different expirations in the cross margin mode are calculated separately. The specific rules are as follows:

Please Note: Depending on risk level, HTX Futures has determined some pairs shall be restricted to tiered margin system when users use leverage except for 1x; While other pairs will not be restricted by tiered margin system in the case of 10x or lower leverage. Take BTC/USDT as an example:

Unit: USDT

[The above data and indicator contents may be adjusted in real time according to market conditions, and the adjustments will be made without further notice.]

[You can use the calculator on the contract trading page to calculate the available amount.>>>Derivatives Trading Calculator Instructions]

Note: As the above chart, Available coefficient of the last tier = 1 / Corresponding leverage

Example 1:

Assume the account equity of Tom’s BTC/USDT swaps is 5,000 USDT, then the higher the leverage the user selects, the smaller the available margin will be:

- When 1x- 50x leverage is selected, the available margin will not change.

- When 75x leverage is selected, the account equity 5,000 USDT belongs to 2nd-tiered available coefficient range. The first 3,000 USDT belongs to the first tier, therefore it will not be affected; For the part that exceeding 3,000 USDT but lower than 23,000 USDT, its available margin equals to “the amount of that part * available coefficient”, therefore Tom’s tiered available margin under the 75x leverage = 3,000 + (5,000-3,000) * 50%=4,000 USDT;

- When 100x leverage is selected, the account equity 5,000 USDT belongs to the 3rd-tiered available coefficient range. The first 2,500 belongs to the first tier, therefore this part will not be affected; For the second part that exceeding 2,500 USDT but lower than 4,000 USDT, it belongs to the second tier whose available coefficient is 50%; hence the corresponding available margin is 2,500+(4,000-2,500) * 50% = 3,250 USDT. For the third part that exceeding 4,000 USDT but lower than 40,000 USDT, it belongs to the third tier whose available coefficient is 20%; hence the corresponding available margin equals to “the amount of that part * available coefficient”. Then, Tom’s tiered available margin under the 100x leverage = 3,250+(5,000-4,000) * 20% = 3,450 USDT.

Example 2:

Assume Tom transfers a million USDT to his cross margin account. When using 20x leverage, his position margin is 350,000 USDT for cross-margined BTC/USDT swaps trading. If Tom still wants to open a position of cross-margined ETH/USDT swaps under the 20x leverage, how much margin is available there?

- Firstly, the position margin (350,000 USDT) of BTC/USDT swaps under the 20x leverage has entered the tiered available margin range, therefore, we need to reversely deduce that the position margin actually occupied by this position equals to 250,000 + (350,000-250,000) / 33.33%=550,000 USDT;

- Due to the fact that BTC/USDT has occupied 550,000 USDT, there are 450,000 USDT (1,000,000 – 550,000) available to be used for other positions, and it will also be affected by tiered available margin system;

- If Tom still wants to open a position of cross-margined ETH/USDT swaps under the 20x leverage, based on the tiered available margin range of ETH/USDT, for the part that exceeding 300,000 USDT but lower than 600,000 USDT, the corresponding available margin equals to “the amount of that part * available coefficient”. Then, Tom’s tiered available margin = 120,000 + [(450,000-300,000) * 20%] =150,000 USDT.

Example 3:

Assume Tom transfers a million USDT to his cross margin account. His position margin is 300,000 USDT for cross-margined BTC/USDT swaps trading when using 20x leverage. And his positon margin is 100,000 USDT for BTC/USDT quarterly futures trading while using 30x leverage. His position margin is 50,000 USDT in BTC/USDT bi-weekly futures trading when using 30x leverage. If Tom still wants to open a position of cross-margined ETH/USDT swaps under the 20x leverage, how much margin is available there?

- Firstly, the position margin (300,000 USDT) of BTC/USDT swaps under the 20x leverage has entered the tiered available margin range, therefore, we need to reversely deduce that the position margin actually occupied by this position equals to 250,000 + (300,000-250,000) / 33.33% = 400,000 USDT;

- Then again, position margin (100,000 USDT) of BTC/USDT quarterly futures under the 30x leverage has entered the tiered available margin range. Therefore, we need to reversely deduce that position margin actually occupied by this position equals to 35,000+(100,000-35,000)/50.00%=165,000 USDT;

- Then again, position margin (50,000 USDT) of BTC/USDT bi-weekly futures under the 30x leverage has entered the tiered available margin range. Therefore, we need to reversely deduce that position margin actually occupied by this position equals to 35,000+(50,000-35,000)/50.00%=65,000 USDT;

- Due to the fact that BTC/USDT swaps has occupied 400,000 USDT, BTC/USDT quarterly futures has occupied 165,000 USDT, and BTC/USDT bi-weekly futures has occupied 65,000 USDT, there are 370,000 USDT (1,000,000 – 400,000-165,000-65,000) available to be used for other positions, and it will also be affected by tiered available margin system;

- If Tom still wants to open a position of cross-margined ETH/USDT swaps with 20x leverage, based on the tiered available margin range of ETH/USDT swaps, for the part that exceeding 300,000 USDT but lower than 600,000 USDT, the corresponding tiered available margin equals to “the amount of that part * available coefficient 20%”. Then, Tom’s tiered available margin = 120,000 + (370,000 – 300, 000) * 20.00% = 134,000 USDT.

Locked Margin Optimization Scheme

To improve asset utilization and reduce position margin for users, HTX USDT-margined contracts implement locked margin optimization scheme when users have long and short positions of the same pair in the same mode. In this way, part of position margin will be reduced. The specific formula is as below:

New Position Margin = Long Position Margin+ Short Position Margin – Locked Margin * Optimization Ratio of the Locked Margin

Position Margin = Contract Face Value * Position Amount * Last Price / Leverage

Locked margin = min (Long Position Margin, Short Position Margin)

Optimization ratio of the locked margin is 100%.

Please Note: New position margin (account) under the cross margin mode = Σ New position margin of all USDT-margined contracts in the cross margin account.

For example,

Tom holds both long and short positions of BTC/USDT swaps and BTC/USDT quarterly futures in the cross margin account. Then the new position margin is calculated as below:

| Contract | Leverage | Last Price (USDT) | Long Position Amount (cont) | Short Position Amount (cont) |

| BTC/USDT Swaps | 20 | 10,000 | 1,000 | 500 |

| BTC/USDT Quarterly | 20 | 11,000 | 300 | 200 |

To calculate Tom’s separate margin for the long and short positions of BTC/USDT swaps and quarterly futures. According to the formula, Position margin = Face Value * Position Amount * Last Price / Leverage

① In terms of BTC/USDT swaps, the Long position margin is 0.001 * 1,000 * 10,000 / 20 = 500 USDT, and the short position margin is 0.001 * 500 * 10,000 / 20 = 250 USDT;

② In terms of BTC/USDT quarterly contract, the Long position margin is 0.001 * 300 * 11,000 / 20 = 165 USDT, and the short position margin is 0.001 * 200 * 11,000 / 20 = 110 USDT.

To calculate Tom’s locked margin. According to the formula, Locked Margin = min (Long Position Margin, Short Position Margin), then

Locked margin for BTC/USDT swaps =min (500, 250) = 250 USDT;

Locked margin for BTC/USDT Quarterly = min (165, 110) =110 USDT;

To calculate Tom’s new position margin.

New position margin for BTC/USDT swaps = 500 + 250-250 * 100% = 500 USDT;

New position margin for BTC/USDT Quarterly = 165 + 110-110 * 100% = 165 USDT;

Hence, the new position margin for the cross margin account = 500 + 165 = 665 USDT;

Thus it can be seen Tom’s new position margin is 665 USDT by using this optimization mechanism, which is much lower than its original margin (500+250+165+110 = 1,025 USDT).

Calculation for Available Asset for Transfer

Available Asset for Transfer = max {0, Current-period Initial Equity + Current-period Transfer_in - Current-period Transfer_out – max (0, the remaining of the trial bonus) + min (Unrealized PnL, 0) + min (0, Realized PnL) - max [0, f(Occupied) - max (0, Realized PnL)]} + max {0, [Realized PnL - f (Occupied)]} * Available Coefficient of Realized PnL.

Note: The available coefficient of assets settled periodically is 0, and the available coefficient of assets settled in real-time is 1.

Example 1:

1) Assume Tom’s initial equity in the isolated-margined BTC/USDT swaps account was 500 USDT, and opened a long position of 100 conts swaps with 5X leverage and its entry Price of 10,000 USDT. When the price rises to 12,000 USDT, the available asset for transfer is calculated as below (transaction fees will be negligible):

Unrealized PnL = (12,000 – 10,000) * 0.001 * 100 = 200 USDT;

f(Occupied) = Occupied margin = 100 * 0.001 * 12,000 / 5 = 240 USDT;

Available asset for transfer = max [0,500+0-0+0+0-240]+ 0 = 260 USDT.

2)Assume Tom’s initial equity in the cross margin account was 500 USDT and he used 5x leverage. Then he opened a long position of 100 conts swaps at the price of 10,000 USDT and a long position of 50 cont BTC/USDT Quarterly futures at the price of 11,000 USDT. When the price of BTC/USDT swaps rises to 12,000 USDT and the price of BTC/USDT Quarterly rises to 12,500 USDT, the available asset for transfer is calculated as below (transaction fees will be negligible):

Unrealized PnL of BTC/USDT Swaps = (12,000 – 10,000) * 0.001 * 100 = 200 USDT

Unrealized PnL of BTC/USDT quarterly = (12,500 – 11,000) * 0.001 * 50 = 75 USDT

f(Occupied) of BTC/USDT Swaps = Occupied margin = 100 * 0.001 * 12,000 / 5 = 240 USDT

f(Occupied) of BTC/USDT Quarterly = Occupied margin = 50 * 0.001 * 12,500 / 5 = 125 USDT

Total f(Occupied) = 240 + 125 = 365 USDT

Available asset for transfer = max[0,500+0-0+0+0-365]+ 0 = 135 USDT

Example 2:

1)Assume Tom’s initial equity in the isolated-margined BTC/USDT swaps account was 50,000 USDT, and opened a long position of 100,000 conts swaps with leverage 100X and its entry Price of 10,000USDT. When the price reached 12,000 USDT, he closed 50,000 conts. Then the price declines to 9,000USDT, at this time, the available asset for transfer is calculated as below (transaction fees will be negligible):

Unrealized PnL = (9,000 – 10,000) * 0.001 * 50,000 = -50,000 USDT

Realized PnL = (12,000 – 10,000) * 0.001 * 50,000 = 100,000 USDT

Occupied margin = 50,000 * 0.001 * 9,000 / 100 = 4,500 USDT

However, when using the 100X leverage, the available margin is limited by the tiered margin system and the corresponding available coefficient turns to be 20.00%, then the actual f(Occupied) needs to be calculated as below:

f(Occupied) = 4,000 + (4,500 – 3,250) / 20.00% = 10,250 USDT

Available asset for transfer = max[0,50,000+0-0+0-50,000-0]+(100,000 – 10,250)= 89,750 USDT

2)Assume Tom’s initial equity in the cross margin account was 50,000 USDT and he used 100x leverage. Then he opened a long position of 100,000 conts swaps at the price of 10,000 USDT and a long position of 50,000 conts BTC/USDT quarterly at the price of 11,000 USDT. When the price of BTC/USDT swaps rose to 12,000 USDT, he closed 50,000 conts. Then BTC/USDT swaps price dropped to 9,000 USDT. Meanwhile, he closed 30,000 conts BTC/USDT Quarterly futures when the price rose to 12,500 USDT, then the price fell to 10,000 USDT. The available asset for transfer is calculated as below (transaction fees will be negligible):

Unrealized PnL of BTC/USDT Swaps = (9,000 – 10,000) * 0.001 * 50,000 = -50,000 USDT

Unrealized PnL of BTC/USDT quarterly = (10,000 – 11,000) * 0.001 * 20,000 = -20,000 USDT

Realized PnL of BTC/USDT Swaps= (12,000 – 10,000) * 0.001 * 50,000 = 100,000 USDT

Realized PnL of BTC/USDT quarterly = (12,500 – 11,000) * 0.001 * 30,000 = 45,000 USDT

Occupied Margin of BTC/USDT Swaps = 50,000 * 0.001 * 9,000 / 100 = 4,500 USDT

Occupied Margin of BTC/USDT quarterly = 20,000 * 0.001 * 10,000 / 100 = 2,000 USDT

However, when using the leverage 100X, the available margin is limited by the tiered margin system, and the available coefficient turns to be 20.00% for BTC/USDT swaps and 100 % for BTC/USDT quarterly, then the actual f(Occupied) needs to be calculated as below:

f(Occupied) of BTC/USDT Swaps = 4,000 + (4,500 – 3,250) / 20.00% = 10,250 USDT

f(Occupied) of BTC/USDT Quarterly = 2,000 USDT

Total f(Occupied) =10,250 + 2,000=12,250 USDT

Available asset for transfer= max[ 0,50,000+0-0+0-70,000-0 ]+ (145,000 – 12,250)=132,750 USDT

In conclusion, when the account equity exceeds a certain range and users use larger leverage, the available margin will be restricted by the tiered margin system. Then the margin actually required to occupy becomes more, and the remaining available asset for transfer becomes relatively less.