Futures Margin Explained & Steps to Adjust Margin Leverage

- Must-Read for Beginners

Go to Rewards Hub to win up to 5,672 USDT rewards!

Typically, in virtual assets futures trading, traders don't have to pay the full amount on the notional value of the contract, instead, they just need to pay a certain percentage of the full amount as the margin assets. And this certain percentage for opening a futures position is called the initial margin.

The margin needed in a virtual asset futures position dramatically changes with the market prices. When the last price fluctuates, the margin ratio of a futures position would change as well. When the margin ratio increases, a margin call may be triggered and the trader needs to add more margin assets to avoid their position from being liquidated in case of further adverse market movement.

The initial margin ratio depends on the leverage selected when opening a futures position.

In HTX Futures, 1x, 5x, 10x, and 20x leverage corresponds to initial margin ratio of 100%, 20%, 10%, and 5% respectively. (Initial margin ratio = 1/leverage)

With the required initial margin paid, traders can leverage a futures position several times or even dozens of times the margin value. In this sense, the margin system for futures trading can improve fund utilization efficiency.

How to set up margin & leverage?

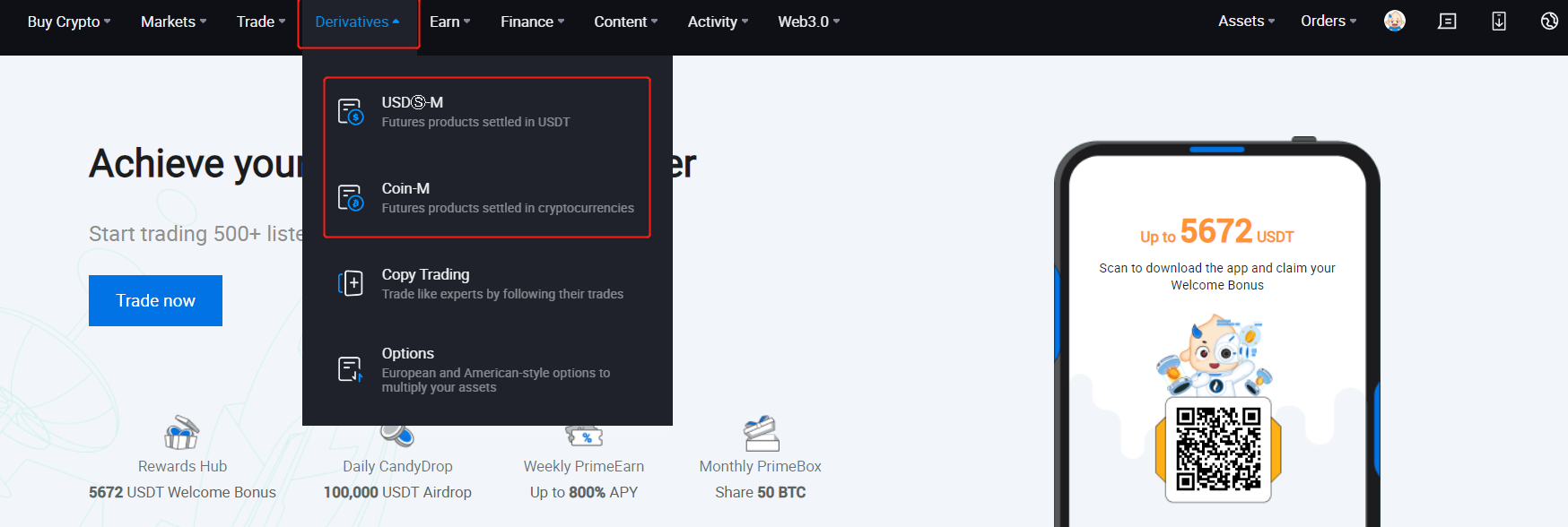

Step 1: Access HTX's official website, click the "Derivatives" in the navigation bar, and select USDT-M futures or Coin-M futures according to your needs.

Step 2: Click to set leverage in the upper right corner of the Order Sector.

Step 3: Select leverage, which determines the margin ratio, depending on your risk appetite and risk tolerance.