INJ (Injective Protocol) Introduction

- Project Introduction

1. Brief Introduction

Injective enables the trading of decentralized derivatives. The platform is able to support the trading of any market. Anytime. Anywhere.

2. Detailed Introduction

What is Injective Protocol (INJ)?

Injective Protocol is a universal DeFi protocol for cross-chain derivatives trading across a variety of financial products such as perpetual swaps, futures, and spot trading. The platform utilizes both the Ethereum and Cosmos ecosystems via peg zones in order to create a fast cross-chain trading infrastructure without gas fees expenses. Injective aims to build a network that is trustless, censorship-resistant, publicly verifiable, and front-running resistant.

Injective is backed by titans in the blockchain space such as Pantera Capital, and Hashed.

Injective Value Proposition

Injective provides a vertically integrated infrastructure that allows anyone to create and trade on any derivative market. Injective has released perpetual swaps and expiry futures with more along the way. They have also released the first ever decentralized trading for assets such as forex, stocks, and yield farming derivatives.

Key Highlights

Some of Injective Protocol's key elements include:

- Layer-2 decentralized derivatives trading: Injective is able to achieve fast trading speeds while charging zero gas fees.

- Trade on any market: Injective allows anyone to create and trade on any derivative market using only a price feed, thereby opening up many opportunities for trading on markets not found on other exchanges.

- Cross-chain trading and yield generation: Injective is capable of supporting a diverse array of trading and yield generation activities across distinct layer-1 blockchain networks.

- Community driven network governance: Injective’s network will be governed by its decentralized community in which new listings or network changes are all voted on a Decentralized Autonomous Organization (DAO) structure.

- Liquidity mining incentives: Injective’s community will be able to capture value via liquidity mining programs that have been natively built onto the network to spur continuous growth.

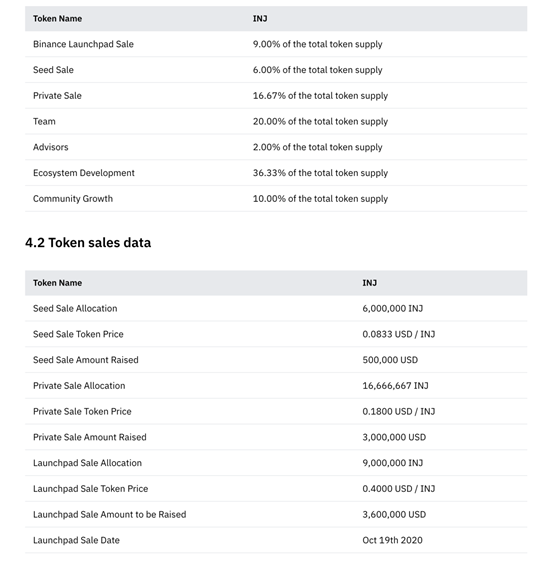

3. Token Information and Release Schedule

- Total Token Supply: 100,000,000 INJ (Updated on 2021/01/19)

- Circulating Supply: 15.22% (Updated on 2021/01/19)

- Private Round Price: $0.18

- Public Round Price: $0.40

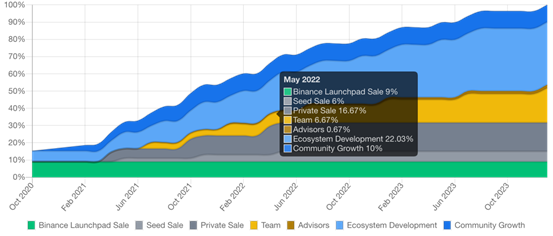

- Token Lock-up plan and release plan:

4. Related links

- All Injective Social Links: https://linktr.ee/injective

- Official website: https://injectiveprotocol.com/

- Technical Documentation: https://docs.injectiveprotocol.com/#introduction

- Twitter: https://twitter.com/injectivelabs

- Telegram: https://t.me/joininjective

- Discord: https://discord.gg/injective

- YouTube: https://www.youtube.com/channel/UCN99m0dicoMjNmJV9mxioqQ?sub_confirmation=1?sub_confirmation=1

Note: The project introduction comes from the materials published or provided by the official project team, which is for reference only and does not constitute investment advice. Some of the content may be out of date, error or omission. HTX does not take responsibility for any resulting direct or indirect losses.