DHT (dHEDGE) Introduction

- Project Introduction

1. Brief Introduction

dHEDGE: Non-custodial mimetic trading for synthetics on Ethereum

2. Detailed Introduction

dHEDGE is a decentralized asset management protocol connecting the world’s best investment managers with investors on the Ethereum blockchain in a permissionless, trustless fashion.

No minimum asset size required to be an investment manager, enabling the best managers to rise to the top no matter where they come from or their background.

Real-time tracking of top hedge fund managers performance courtesy of dHEDGE leaderboard.

Supported by some of the biggest names in crypto, including Framework Ventures, Three Arrows Capital, BlockTower Capital, DACM, Maple Leaf Capital, Cluster Capital, Lemniscap, LD Capital, IOSG Ventures, NGC Ventures, Bitscale Capital, Divergence Ventures, Genblock Capital, Trusted Volumes, Altonomy, Continue Capital, The LAO and Loi Luu, Co-Founder and CEO of Kyber Network, dHEDGE aims to democratise the investing experience leveraging the unique capabilities of Ethereum and Synthetix.

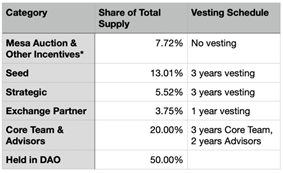

3. Token Allocation

4. Token Information and Release Schedule

- Total Token Supply: 100,000,000

- Circulating Supply: Less than 7.72M

- Private Round Price: USD 0.25

- Public Round Price: Public Auction Sep 17, 2020

- Token Lock-up plan and release plan

5. Related links

- Official website: www.dHEDGE.org

- Social media

- https://t.me/dhedge

- https://twitter.com/dhedgeorg

- https://discord.gg/rVuvXmY

All the above information is provided by DHT (dHEDGE).