Announcement on the Launch of HTX Futures Locked Margin Optimization Function

- Important Announcement

Dear valued user:

To improve asset utilization and to reduce position margin for users, HTX Futures has launched locked margin optimization function at 17:00 on June 12, 2020 (GMT+8).

1. When users have the same type futures with long and short positions for one coin, the optimization ratio for locked margin of the same type futures is 100%. And the formula for calculating the locked margin is as below:

Long position margin of the same type futures = (Long position conts of the same type futures*Contract face value/ Latest price / Leverage)

Short position margin of the same type futures = (Short position conts of the same type futures*Contract face value/ Latest price / Leverage)

Locked margin of the same type futures = min (Long position margin of the same type futures, Short position margin of the same type futures)

Locked margin = Total long and short position of the same type futures - Total locked margin of the same type futures*Optimization ratio for the same types futures.

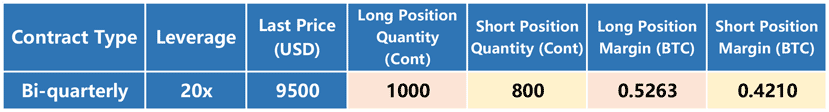

Example: Tom holds long positions of 1000 conts and short positions of 800 conts BTC Quarterly futures contracts with 20x leverages. The BTC futures contract face value is 100 USD and the latest price of BTC Quarterly futures contract is 9500 USD. Then we can calculate Tom’s locked margin as following:

- Total long and short position margin of the same type futures=100 * 1000 / 9500 / 20 + 100 * 800 / 9500 / 20=0.9473 BTC

- Total locked margin of the same type futures= min (100 * 1000 / 9500 / 20, 100 * 800 / 9500 / 20) = 0.4210 BTC

- Locked margin = 0.9473 - 0.4210 *100% = 0.5263 BTC

2. When users have several types futures with long and short positions for one coin, the optimization ratio for locked margin of the same type futures is 100% and the optimization ratio for locked margin of all types futures is 50%. The formula for calculating locked margin is as below:

Total long and short position margin = The sum of long position margin of all types futures + The sum of short position margin of all types futures

Total locked margin = min (The sum of long position margin of all types futures, The sum of short position of all types futures)

Total locked margin of the same type futures = min (Long position margin of weekly futures, Short position margin of weekly futures) + min (Long position margin of bi-weekly futures, Short position margin of bi-weekly futures) + min (Long position margin of quarterly futures, Short position margin of quarterly futures) + min (Long position margin of bi-quarterly futures, Short position margin of bi-quarterly futures)

Total locked margin of all types futures = Total locked margin - Total locked margin of the same type futures

Locked margin = Total long and short position margin - Total locked margin of the same type futures *Optimization ratio for the same type futures - Total locked margin of all types futures* Optimization ratio for all types futures

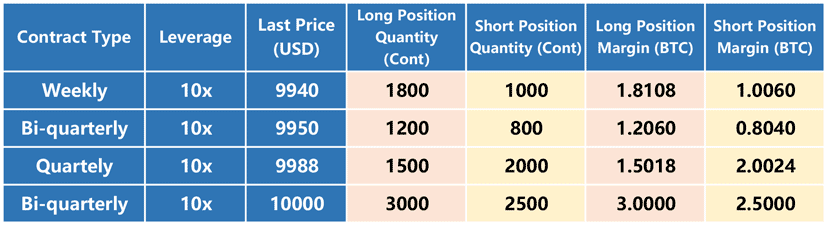

Example: Tom has long and short positions of all the four types BTC contracts with 10x leverages, and the BTC contract face value is 100 USD. Now we can calculate Tom’s locked margin through following steps:

According to the formula:

- Total long position margin of all types futures = 1.8108 + 1.2060 + 1.5018 + 3.0000 = 7.5186 BTC;

- Total short position margin of all types futures = 1.0060 + 0.8040 + 2.0024 + 2.5000 = 6.3124 BTC;

- Total long and short position margin = 7.5186 + 6.3124 = 13.8310 BTC.

- Total locked margin = min (7.5186, 6.3124) = 6.3124 BTC

- Total locked margin of the same type futures = min (1.8108, 1.0060) + min (1.2060, 0.8040) + min (1.5018 + 2.0024) + min (3.0000, 2.5000) = 5.8118 BTC;

- Total locked margin of all types futures = 6.3124-5.8118 = 0.5006 BTC

- Locked margin = 13.8310-5.8118 * 100%-0.5006 * 50% = 7.7689 BTC

Thank you for your support to HTX Futures!

HTX Futures

June 12, 2020