The Complete Guide to HTX Dual Investment

- Options guides

What is HTX Dual Investment?

HTX Dual Investment is a fully customized, non-principal protected investment product, involving two currencies. HTX Dual Investment provides buyers with immediate interest income. At delivery, one of the two currencies is returned. This product has an optional callable feature designed to reduce the risk in exchange for a lower yield.

How does HTX Dual Investment work?

A user can purchase a HTX Dual Investment product with available investment assets. Upon purchase, the user can select a dual investment product, purchase amount, strike price, product expiry date, and callable price (optional). After the purchase is made, the interest income from this product is earned and distributed to the user’s Options account immediately. Upon the product expiry (delivery) date, the initial investment assets will be returned to the user in full or be converted into the alternate currency with the strike price as conversion rate and returned, depending on whether the product is “exercised”.

There are two types of HTX Dual Investment products, “BTC(ETH)-USDT-Dual” and “USDT-BTC(ETH)-Dual”. All products can be interpreted as “Base Currency-Alternate Currency-Dual”. The base currency is the currency the user uses to purchase the product and the currency of the return at expiry if the product is “not exercised”. The alternate currency is the currency of the return at expiry if the product is “exercised”.

How is the return upon expiry calculated?

For BTC(ETH)-USDT-Dual products,

If an optional Callable price is set upon purchase,

The product is “exercised” if Settlement Price > Strike Price and Settlement Price ≤ Callable Price

The product is “not exercised” if Settlement Price > Callable Price or Settlement Price ≤ Strike Price

If an optional Callable price is not set upon purchase,

The product is “exercised” if Settlement Price > Strike Price

The product is “not exercised” if Settlement Price ≤ Strike Price

If the product is “exercised”, the user will receive the return in USDT, with return = Purchase Amount x Strike Price; if the product is “not exercised”, the user will receive the return in BTC (or ETH), with return = Purchase Amount.

For USDT-BTC(ETH)-Dual products,

If an optional Callable price is set upon purchase,

The product is “exercised” if Settlement Price ≤ Strike Price and Settlement Price > Callable Price

The product is “not exercised” if Settlement Price ≤ Callable Price or Settlement Price > Strike Price

If an optional Callable price is not set upon purchase,

The product is “exercised” if Settlement Price ≤ Strike Price

The product is “not exercised” if Settlement Price > Strike Price

If the product is “exercised”, the user will receive the return in BTC (or ETH), with return = Purchase Amount / Strike Price; if the product is “not exercised”, the user will receive the return in USDT, with return = Purchase Amount.

How are the earnings of a HTX Dual Investment product determined?

The earnings are the USDT interest income the user receives right after purchase. They are determined by purchase amount, expiry date, strike price, callable price set by the user, and the underlying asset's current price. Generally, the higher the chance for the product to be “exercised” on the expiry date, the higher the product's earnings. A dual investment product will provide higher earnings when the purchase amount is larger, the strike price is set closer to the current price of the underlying asset, the holding period is longer, no callable price is set, or the callable price is set further away from the strike price.

Some examples

Example 1

Alexa spends 1 BTC to purchase a 30-day BTC-USDT-Dual product with a strike price of 42,000 USDT. She does not set a callable price for the product. Right after purchase, she receives 2,400 USDT as interest income for this product.

When the product expires 30 days later, Alexa will be subject to one of the two scenarios:

Scenario 1: BTC price is above 42,000 USDT

The product is “exercised”, and Alexa receives 1 x 42,000 = 42,000 USDT as return. In total, she receives 44,400 USDT from this product.

Scenario 2: BTC price is below 42,000 USDT

The product is “not exercised”, and Alexa gets 1 BTC back. In total, she receives 2,400 USDT and 1 BTC from this product.

Example 2

Bob spends 6,000 USDT to purchase a 15-day USDT-ETH-Dual product with a strike price of 3,000 USDT and a callable price of 2,000 USDT. Right after purchase, he receives 400 USDT as interest income for this product.

When the product expires 15 days later, Bob will be subject to one of three scenarios:

Scenario 1: ETH price is above 3,000 USDT

The product is “not exercised”, and Bob gets 6,000 USDT back. In total, he receives 6,400 USDT from this product.

Scenario 2: ETH price is above 2,000 USDT and below 3,000 USDT

The product is “exercised”, and Bob receives 6,000 / 3,000 = 2 ETH as return. In total, he receives 2 ETH and 400 USDT from this product.

Scenario 3: ETH price is below 2,000 USDT

The protection from the callable feature is in effect. The product is “not exercised”, and Bob gets 6,000 USDT back. In total, he receives 6,400 USDT from this product.

How to purchase HTX Dual Investment products

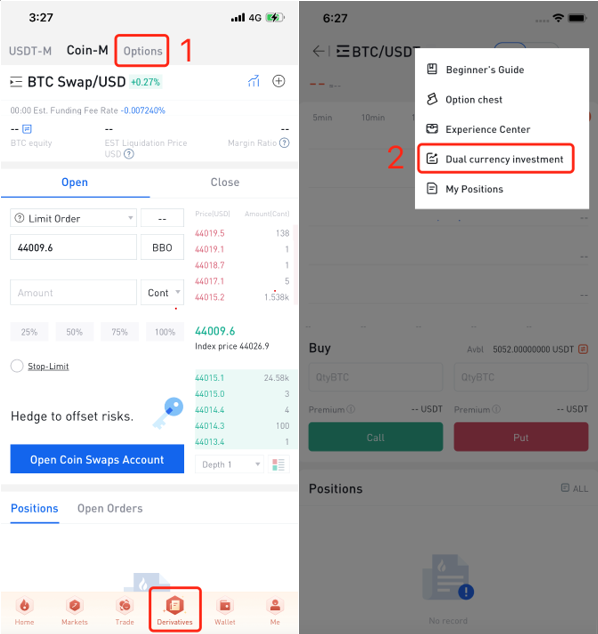

1. Open the HTX app, log in, go to “Derivatives”, then tap “Options”.

2. Tap the three dots icon located on the upper right corner, then tap "Dual Investment".

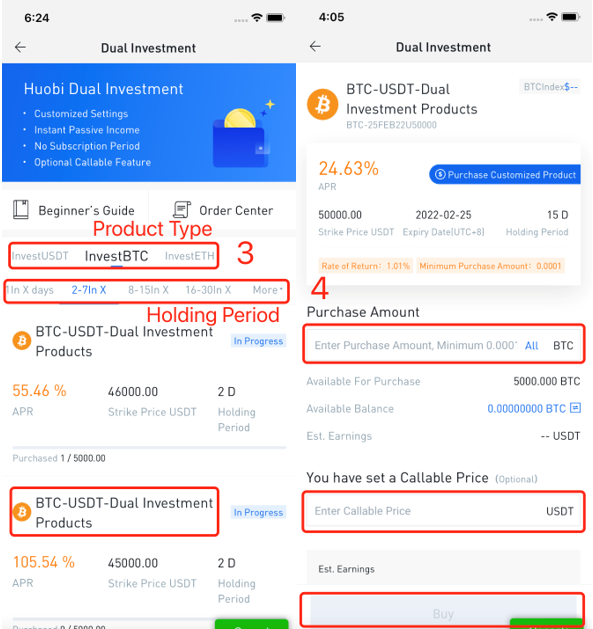

3. Select the product type and the holding period, then tap on the product to buy.

4. This is the product page. Enter the purchase amount and the callable price (optional) for this product. Scroll down the page and tap “Buy” to complete the purchase.

Frequently Asked Questions (FAQ)

Q: Why does my account balance decrease after purchasing the Dual Investment product?

A: Don’t worry. After expiration, the assets you invest will be returned in corresponding assets based on the strike price and delivered to your Options Account.

Q: Which underlying asset types are offered under HTX Dual Investment products?

A: Currently, HTX offers two types of underlying assets: BTC and ETH. The table below summarizes the full list of HTX Dual Investment products.

| Underlying Asset - BTC |

Underlying Asset - ETH |

||||||

| BTC-USDT-Dual |

USDT-BTC-Dual |

ETH-USDT-Dual |

USDT-ETH-Dual |

||||

| Base Currency |

Alternate Currency |

Base Currency |

Alternate Currency |

Base Currency |

Alternate Currency |

Base Currency |

Alternate Currency |

| BTC |

USDT |

USDT |

BTC |

ETH |

USDT |

USDT |

ETH |

The base currency is the currency you use to purchase the product and the currency of the return at expiry if the product is “not exercised”. The alternate currency is the currency of the return at expiry if the product is “exercised”.

Q: What can I get from this product, and when can I get it?

A: You can earn the interest income in USDT immediately after purchase, which will be credited to your Options account. The investment assets will be returned to you in full or be converted into another currency and returned to you upon the expiry (delivery) date.

Q: What is the risk of purchasing this non-principal protected savings product?

A: Non-principal protected means there is certain risk of not getting back the initial investment assets. If the product is “exercised” on the expiry date, your initial investment assets will be converted into the alternate currency with the strike price as conversion rate and returned to you.

Q: What is APR, and how is it calculated?

A: APR is the yearly non-compounding rate of return on the selected product. The formula for calculating APR is shown below:

APR = (Est. Earnings / Market value of Investment Assets) x 365 / Holding Period

Q: How can I view my orders?

A: Please go to [Derivatives] > [Options] > [Dual Currency Investment] > [Order Center]. Here, you can view your open positions and past orders.

Q: Can I get back my investment assets before the expiry date?

A: Unfortunately, once you have purchased the product, you cannot get back the investment assets used to purchase the product before the expiry date.

Q: What are “Strike Price”, “Callable Price”, “Settlement Price”, “Underlying Asset”, “Est. Earnings”, “Holding Period”, “Base Currency”, and “Alternate Currency”?

A:

| Strike Price |

The set price at which the base currency will be converted into the alternate currency if the product is exercised. |

| Callable Price |

The set price to determine whether the protection mechanism is in effect and the product is NOT exercised on the expiry date. |

| Settlement Price |

The underlying asset’s Contract Index Price at 08:00 (UTC) on the expiry date. Settlement Price, Strike Price, and Callable Price (optional) determine whether a product is exercised or not. |

| Underlying Asset |

An asset on which a Dual Investment product is based. For example, if you are referring to BTC settlement price and BTC strike price, then the underlying asset is BTC. |

| Est. Earnings |

The estimated interest income you receive right after purchase. |

| Holding Period |

The length of time between the purchase of the product and its delivery. |

| Base Currency |

The currency you use to purchase the product and the currency of the return on the expiry date if the product is “not exercised”. |

| Alternate Currency |

The currency of the return on the expiry date if the product is “exercised”. |