【Contract Trading101】EP10:How to do hedging using contract trading?

- Contract Trading Tutorial

As companion series of Blockchain 101, issued by HTX, Contract Trading 101 is the beginners guide to understand contract trading-- a practical tool for hedge, arbitrage and speculation.

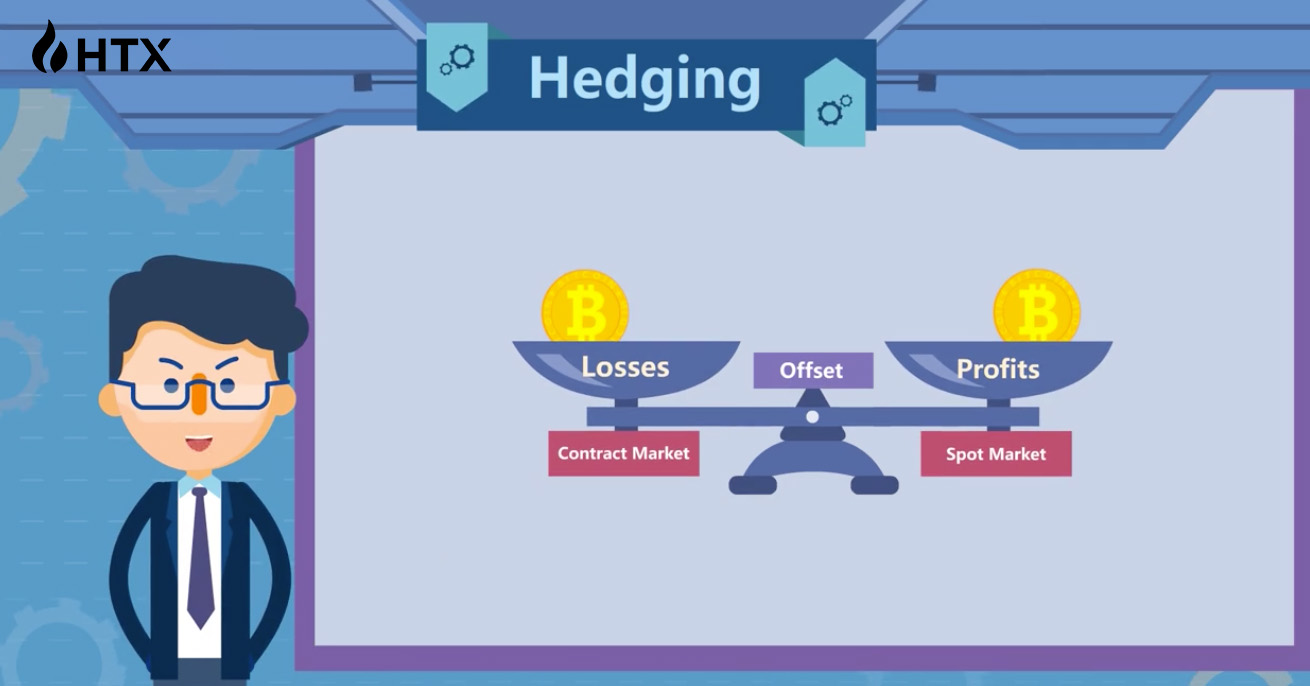

Hedging is to use the profits of contract market to make up for the losses in spot market,

or to use the losses in contract market to offset the profits in spot market, in order to keep the total profit and loss (spot + contract) stable.

For long-term investors who hold a lot of bitcoins, such as bitcoin miners and big bitcoin owners, hedging is an effective way to manage risks and lock in profits.

Hedging can be divided into short hedging and long hedging.

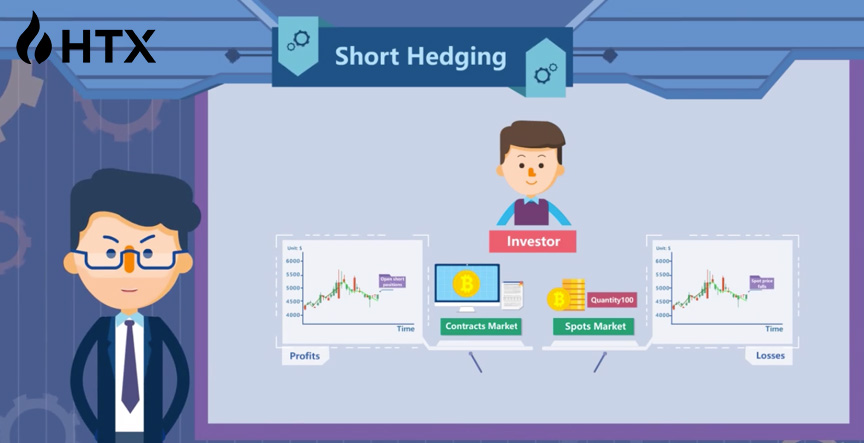

Short hedging means that investors buy in spot market,and open a short position of equivalent size in the corresponding contract market.

In this way, investors can offset the potential losses of spot using the potential profits of contract.

If market price falls, the spot position will lose, but the contract position will gain profits and offset the spot losses.

The other type of hedging is long hedging. Investors want to purchase a certain amount of digital asset in spot market in the future, but they are worried about the potential cost increase if the spot price rises when they make the purchase.

To hedge the risk, investors buy to open a long position of equivalent size in the corresponding contract market in advance.

If the price really rises in the future, the spot purchase cost will increase.

But the contract long position will gain profits which can cover the increased spot purchase cost.