Margin Trading Tutorial

- Margin Trading Guide

Margin Trading allows users to increase their investment exposure given a limited base principal to enjoy multiple returns.

3-Steps taken in Margin Trading:

1) Request for Loan

2) Trade on Margin (Long/Short)

3) Repay Margin Loan and Interest

With the introduction of Cross Margin on HTX, users will have to explicitly input the respective margin type before executing the above 3 steps. Balances on the Cross Margin balance does not show on the Isolated Margin balance.

The following details steps taken for Cross Margin (system defaults to Isolated Margin):

1. Request for Token Loan

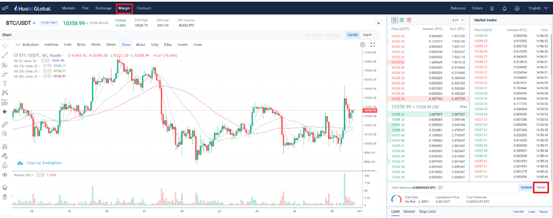

a. Login to your HTX Account (https://www.hbg.com/en-us/ ), click【Margin】at the top menu option and switch Margin Account Type to【Cross】as shown below:

b. Upon entering【Margin】page, select available trading pair on the left

Note:

Cross Margin: allows traders to apply the same margin balance to different trading positions. When the risk rating of the full position margin account reaches 110%, the system will liquidate the margin position.

Isolated Margin: is margin individually set aside for an outstanding margin position, with a fixed collateral amount. If there are multiple margin trading positions held, should one of the positions go into liquidation, margin set aside for other margin positions will not offset this loss and the user would have to top-up the margin for this position.

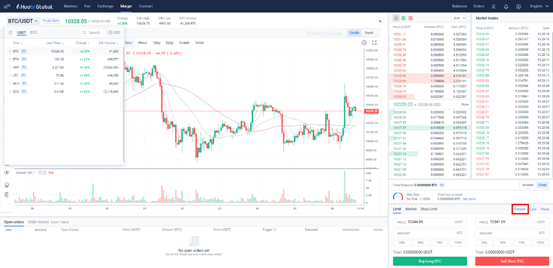

c. Click 【Transfer】 on the Trading Page. User can select and transfer all supported tokens as principal balance for use on Margin, as shown below:

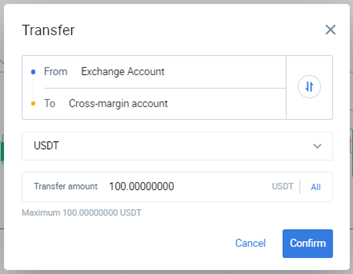

d. Click【Transfer Funds】on the trading page to open a dialog box, input and verify the token and transfer amount as shown below:

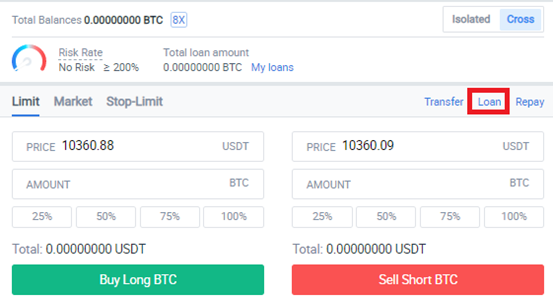

e. Upon successful transfer of the principal balance to the Margin Account, users can start to borrow token by clicking the【Loan】button option on the Trading Panel as shown below:

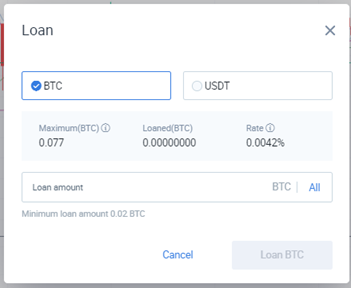

f. Click【Loan】to access dialog box below, maximum available loan amount based on the principal balance will be displayed. Input the requisite loan amount in the input box below. The selected token e.g. BTC below, is the token to be borrowed using USDT transferred into the Margin Account.

Reduce the loan amount if the original input amount exceeds the maximum available loan amount. The loan will be effected and the borrowed token will be reflected in the margin account if there is sufficient principal balance.

Note: Margin loan interest rates fluctuate. Please refer to the margin loan interest rate on your account for actual rate.

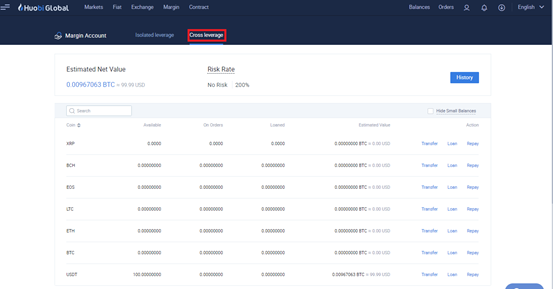

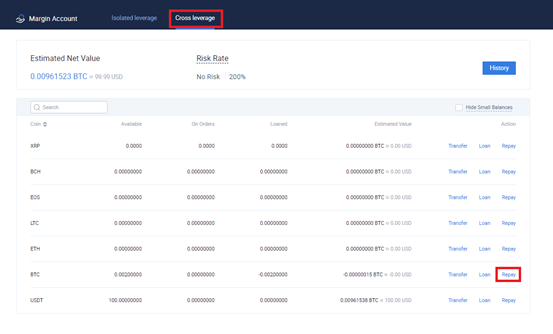

g. Upon successful loan application, loan position will be reflected in the account, and can be verified by accessing【Balances】on the top of the website,【Margin Account】sub-menu option and clicking 【Cross Leverage】tab as below:

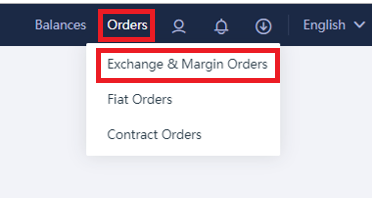

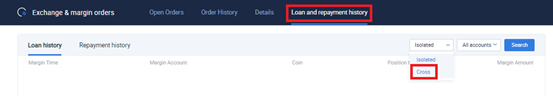

Users can access historical loan application date/time, interest rate and interest records under 【Orders】,【Exchange & Margin Orders】and【Loan and repayment history】and toggling to ‘Cross’ for Cross Leverage activity as shown below:

Note:

Each token has a minimum and maximum loan amount. When the base principal is lower than the minimum loan amount, the available loan amount will reflect as 0. Under this circumstance, please top-up the principal balance from the Margin Account.

Loaned: Total Amount Borrowed To-Date (i.e. successfully applied)

Maximum: Remaining Amount that Can Borrowed

Interest is computed on an hourly basis.

The above sums up the 1st step in Margin Trading – Request for Token Loan.

2. Margin Trading (Long or Short)

Upon receipt of the borrowed token, user can proceed to trade on margin, which involves a Long or Short position. Details as follows:

【Buy Long】: If the expectation is that the token price will rise, transfer funds to the margin account, borrow token, purchase target token at a lower price, sell at a higher price, repay loan and loan interest and earn the price differential.

In the case of Buy Long, borrow USDT to purchase token at a low price and sell at a higher price to earn a profit.

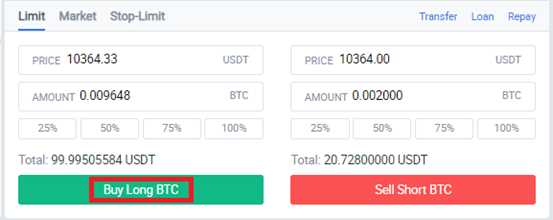

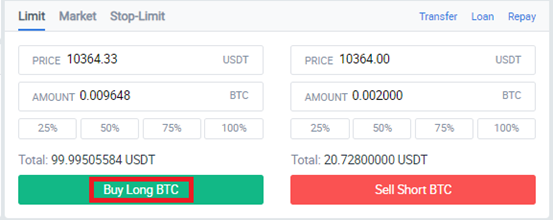

See below for Buy Long BTC screenshot example:

a. At the【Margin】page, there is option to apply limit price, market price and stop-limit buy order

b. When the token price hits the target selling price, input sell order using limit price, market price or stop-limit sell order.

Note:

Select【Market】to sell at market price, largely executable in real-time.

Buy at a low price and sell at a high price, replay the loan and interest on loan, and earn the difference net of principal and paid interest.

Users should monitor market conditions to limit trading loss and avoid liquidation of assets.

End!

【Sell Short】: If the expectation is that the token price will fall, transfer funds to the margin account, borrow token, sell target token at a higher price, buy at a lower price, repay loan and loan interest and earn the price differential.

In the case of Sell Short, borrow the target token (e.g. BTC) to sell token at a high price and purchase at a lower price to earn a profit.

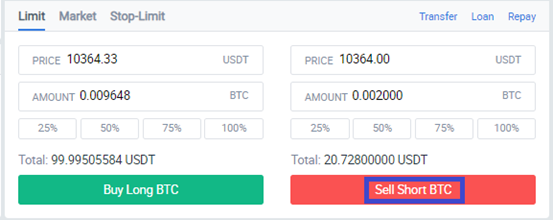

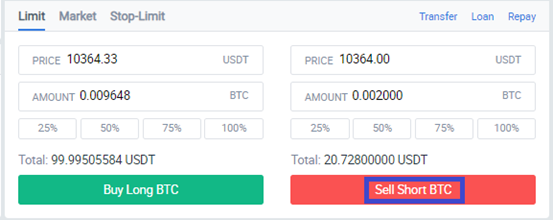

See below for Sell Short screenshot example:

a. Firstly, borrow a fixed quantity of the target token.

b. Upon successfully borrowing the token, sell short on the Margin tab at a high price.

c. Once the price falls to the target level, buy back the token in the Margin tab at a lower price and repay the loan + interest on loan.

Sell at a high price and buy back at a low price, repay the loan and interest on loan. The larger the market price difference, the greater the profit received.

Gentle Reminder:

Margin trading uses a fraction of assets to potentially earn a bigger profit. Whilst accurate prediction of future price movements can allow you to earn a higher profit, if the market moves in the wrong direction, the lost will be correspondingly bigger. As such, ordinary users should avoid taking on highly leveraged trading positions to avoid liquidation of assets.

3. Repay Margin Loan and Interest

a. To payback loaned tokens and interest, access【Balances】on the top of the website,【Margin Account】sub-menu option and clicking 【Cross Leverage】tab as below to check outstanding applications:

b. Click ‘Repay’ button on the right side to access the Repay dialog box, input the quantity to repay, verify input amount and click ‘Confirm’ button. If there is insufficient token quantity to repay the token and interest, it is necessary to top-up transfer into the ‘Margin Account’ the differential amount to successfully return the loan.

Note:

Interest Rate:Interest rate charged is computed as a percentage (%) of the token quantity amount, and on an hourly basis. If the token was borrowed for less than 1 hour, the interest amount computation will round it to an hour.

Gentle Reminder:

It is important to repay token and interest on a timely basis to avoid incur unnecessary charges due to late payment.

Appendix

Margin Trading FAQ

1. What is Margin Trading?

Margin Trading refers to the practice of using borrowed funds from our platform to trade a digital asset, which forms the collateral for the loan. For example, if you have 100 USDT, you can loan from our platform to trade, and your gains can be magnified.

2. How can I apply for loans?

You need to transfer funds to your Margin Account. Once funds are transferred, you can click “Loan” in the Margin Trading page and apply for loans.

3. What is “Long”?

Take the XRP/USDT pair as an example. You can borrow (i.e. take loan) more USDT. Buy XRP at a low price and sell at a high price to gain profits from price spread. Then repay the USDT to our platform.

4. What is “Short”?

Take XRP as an example. You can borrow (i.e. take loan) more XRP. Sell XRP at a high price and buy at a low price to gain profits from the price spread. Then repay the XRP to our platform.

5. Under what circumstances will my account be forced into Liquidation?

Isolated Margin: When the risk rating of the respective margin trading position falls below 110%, the system will force liquidate the position and the funds will be taken back.

Cross Margin: When the risk rating of the cross margin account falls below 110%, the system will force liquidate the position and the funds will be taken back.

6. How is Risk Rate calculated?

Total Asset (Tradable Balance + Loaned Amount) / (Loaned Amount + Interest Payable) x 100%

7. Why can’t I transfer funds from Margin Account when I have funds?

Withdrawable Balance = Total Assets – 2 x (Loaned Amount+ Interest Payable). You can refer to details on the page.

8. How much Interest should I pay for Margin Trading?

Interest is charged according to the percentage of the loan amount. One hour/60 minutes is considered as a unit. Any time less than 60 minutes will be considered as one hour. You can refer to details of Interest Rate on the page.

9. How much is the leverage?

Each trading pair has different leverages. You can refer to details on the page.

10. How can I check the risk rate on my account?

To check your risk rate, please navigate and click on the top menu 【Balances】 –> 【Margin Account】-> Toggle between the tabs Cross leverage/Isolated leverage to see their respective risk rates.

11. How can I check my loan history?

Users can access historical loan application date/time, interest rate and interest records under 【Orders】,【Exchange & Margin Orders】and【Loan and repayment history】.

12. How can I repay the loan?

Click on the ‘Repay dialog box on the Margin Trading page or via 【Balances】 –> 【Margin Account】-> Toggle between the tabs Cross leverage/Isolated leverage.

Note:

If there is a difference in the pictures or fee rates between this article and HTX pages, please refer to HTX pages. Enjoy your trading!