【Contract Trading101】EP9:What is the underlying in digital asset contract trading?

- Contract Trading Tutorial

As companion series of Blockchain 101, Contract Trading 101 is the beginners guide to understand contract trading-- a practical tool for hedge, arbitrage and speculation.

Digital asset contract trading is similar to traditional financial derivatives trading.

But unlike traditional financial derivatives trading,digital asset contract trading does not trade with fiat currency.

Digital asset contracts take digital assets as the underlying.

The contracts are priced in US dollars, and settled in digital asset price difference.

For example.

When BTC price is $5,000, Xiao Ming opens a long position, he uses 1BTC as the margin, places an “Open Long” order, and enters into a long position of 50 contracts (each contract has a face value of $100).

In this digital asset contract, the underlying is BTC (digital asset).

Then BTC rises to $5,500, and Xiao Ming closes the long position.

After closing the position, Xiao Ming earns 0.09 BTC (i.e. he earns the 500 USD price difference).

Throughout this example we use USD to demonstrate costs and profits.

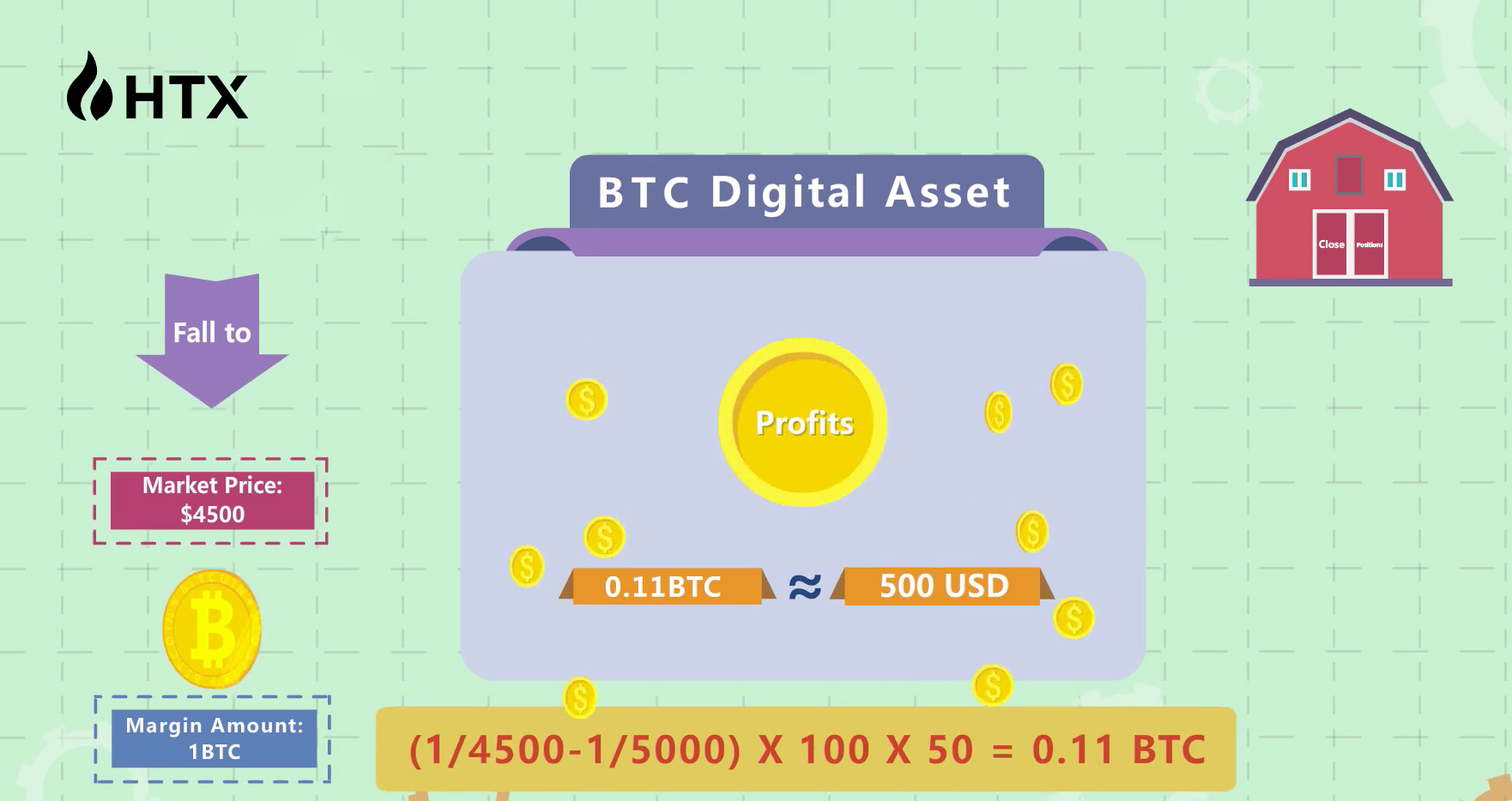

Now suppose Xiao Ming opens a short BTC position at price $5000.

Using 1BTC as the margin, he sells to open a short position of 50 contracts (each contract has a face value of $100), in this contract, the underlying is still BTC.

Then BTC falls to $4,500, and Xiao Ming chooses to close the position.

He buys to close the short position at $4500, and earns 0.11 BTC (i.e. he earns the 500 USD price difference).

To sum up: the underlying of digital asset contract trading is the corresponding digital asset.