【Contract Trading101】EP8:Leverage in contract trading

- Contract Trading Tutorial

As companion series of Blockchain 101, issued by HTX, Contract Trading 101 is the beginners guide to understand contract trading-- a practical tool for hedge, arbitrage and speculation.

Leverage is a common financial tool.

It amplifies investments through the margin mechanism.With leverage, risks and returns are both amplified.

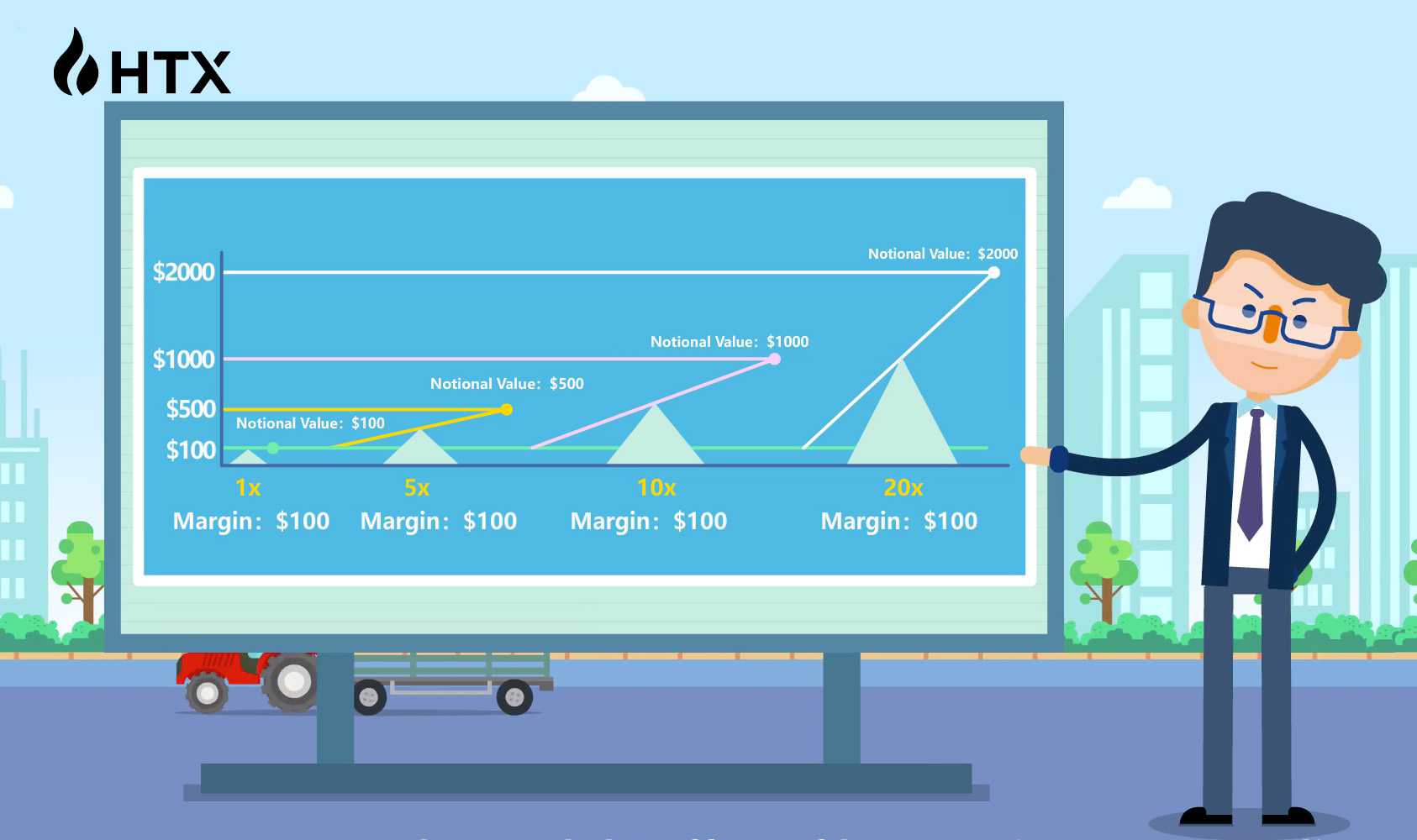

After using leverage, the profit and loss of investors are decided not by the amount of margin,but by the amount of notional value after leverage amplification.

For example. When BTC market price is $5,000, Xiao Ming uses one BTC as margin,

he chooses 10x leverage, and enters into a long position that is worth 10 BTCs (i.e. 500 contracts with each contract having a face value of $100).

If BTC market price rises by 1%, i.e. from $5,000 to $5050,then the profit of this contract position is 0.099 BTC.

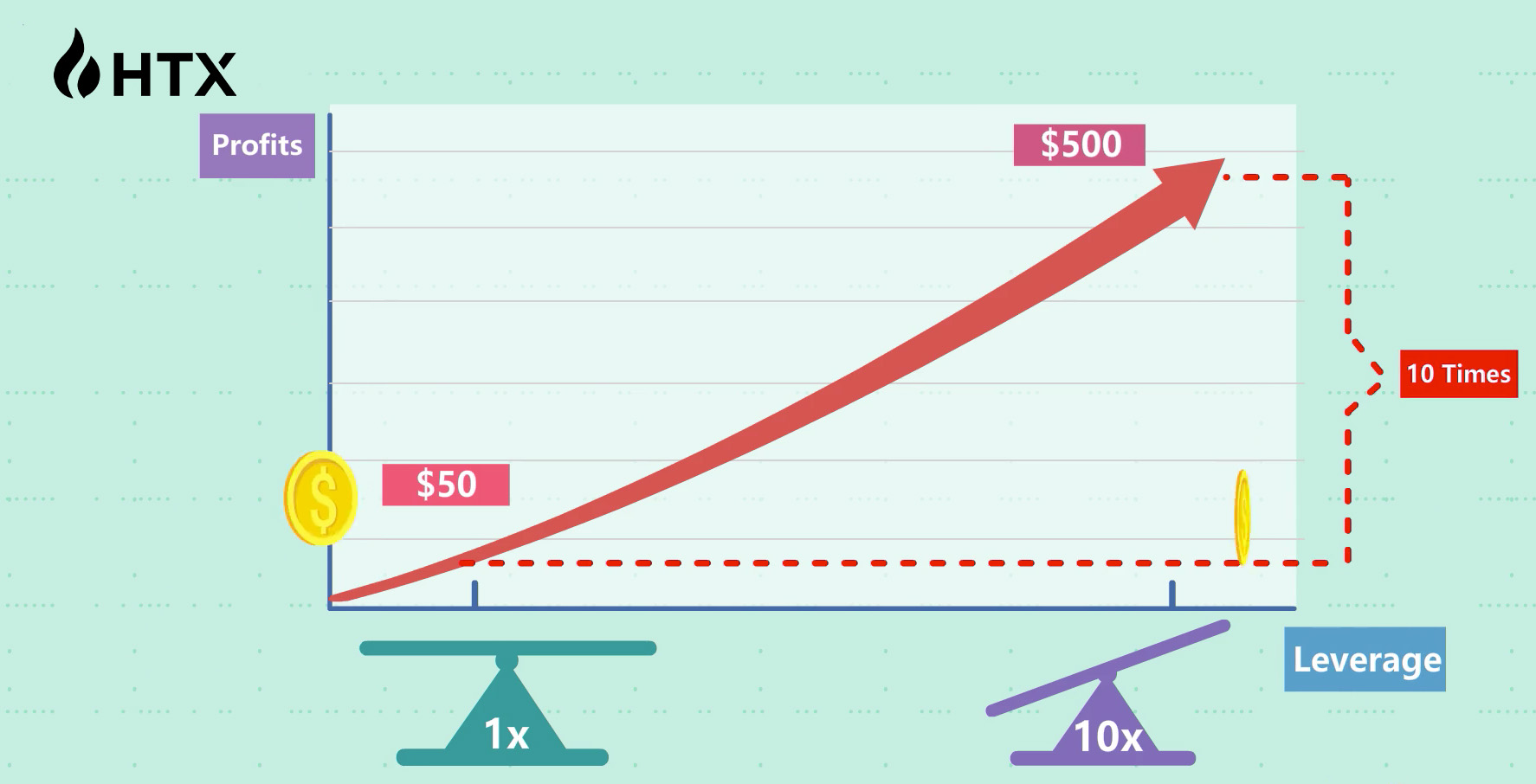

With 10x leverage, Xiao Ming uses $5000 to gain $500 profits in the contract market.

If he chooses 1x leverage, with 1 BTC as margin, he can enter into a long position that is worth only 1 BTC (i.e. 50 contracts with each contract having a face value of $100).

When the BTC market price rises to $5050, his profit is 0.0099 BTC, earning only $50.

Comparing 10x with 1x leverage, there is a tenfold variation in terms of profits gained by Xiao Ming.

Note that leverage amplifies both profits and losses. With leverage higher than 1, you can earn more if you are right on the market direction, you can also lose more if you are wrong.

Through the margin mechanism, investors can use leverage to trade large notional value with only a small amount as the margin.

Now, you understand the effect of leverage in contract trading.