【Contract Trading101】EP6:What do Maker and Taker mean in contract trading?

- Contract Trading Tutorial

As companion series of Blockchain 101, Contract Trading 101 is the beginners guide to understand contract trading-- a practical tool for hedge, arbitrage and speculation.

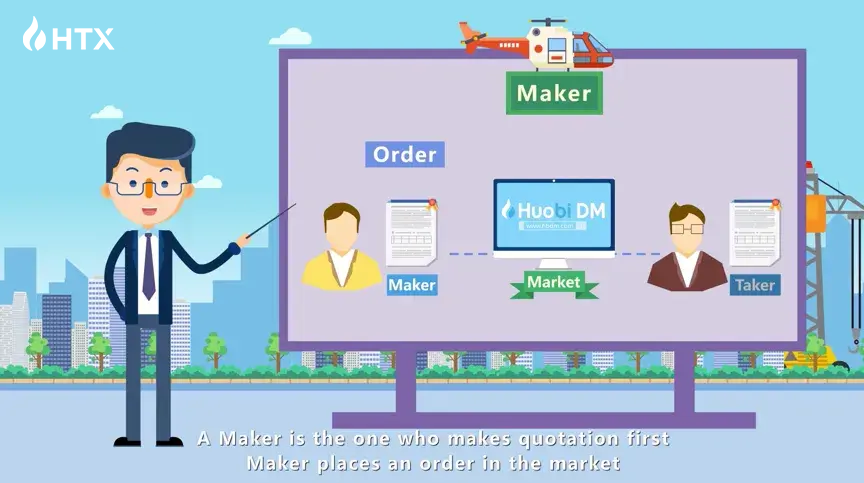

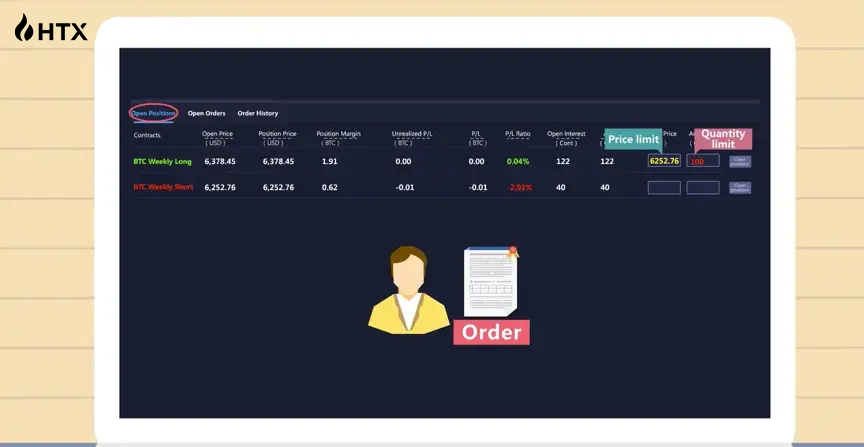

A Maker is the one who makes quotation first. Maker places an order in the market,limiting its price and quantity, and then waits for other users to deal with it.

If no order matches with it in the market, the Maker’s order will remain in the exchange's order book, providing quotation for the entire market (This is so called “make the market” and therefore it is termed Maker).

A Taker is the one who takes the quotation given by a Maker.

Based on the orders listed in the order book, a taker places an order with certain quantity and price which trades immediately with existing orders.

If the Taker’s order is large and only partially filled, in this case, as long as it is a limit order and is not cancelled, it will become a new Maker’s order, showing in the order book and waiting for others to deal with it.

In summary: Makers quote first, helping to make the market, if price matches, Takers trade immediately with Makers’ orders.