【Contract Trading101】EP2:What’s the difference between spot transaction and contract trading?

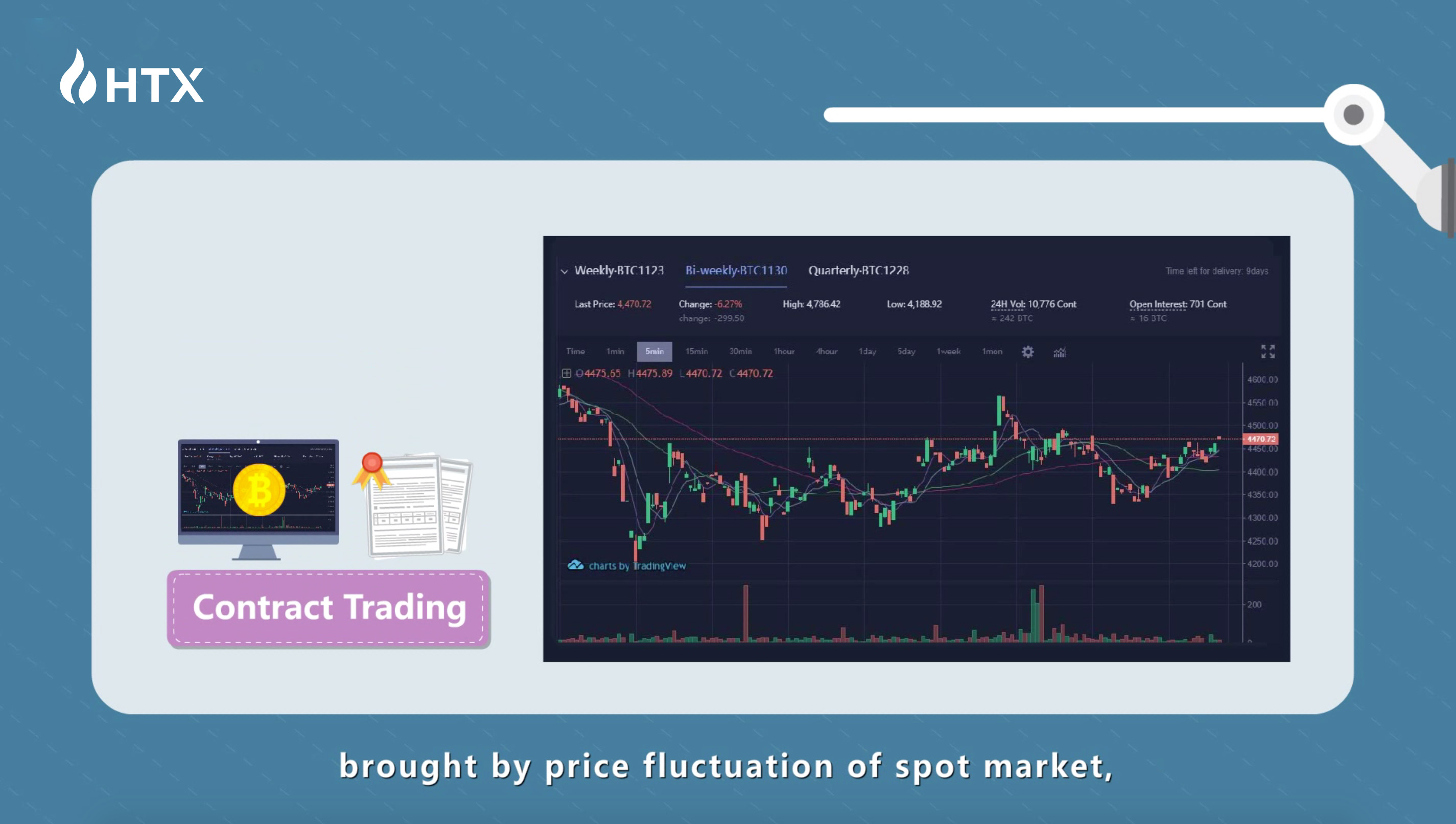

- Contract Trading Tutorial

As companion series of Blockchain 101, issued by HTX, Contract Trading 101 is the beginners guide to understand contract trading-- a practical tool for hedge, arbitrage and speculation.

The main differences between spot transaction and contract trading:

First, the underlying objects are different.

Spot transaction deals with commodity itself, including samples and material objects.

Most of our daily transactions are spot transactions.

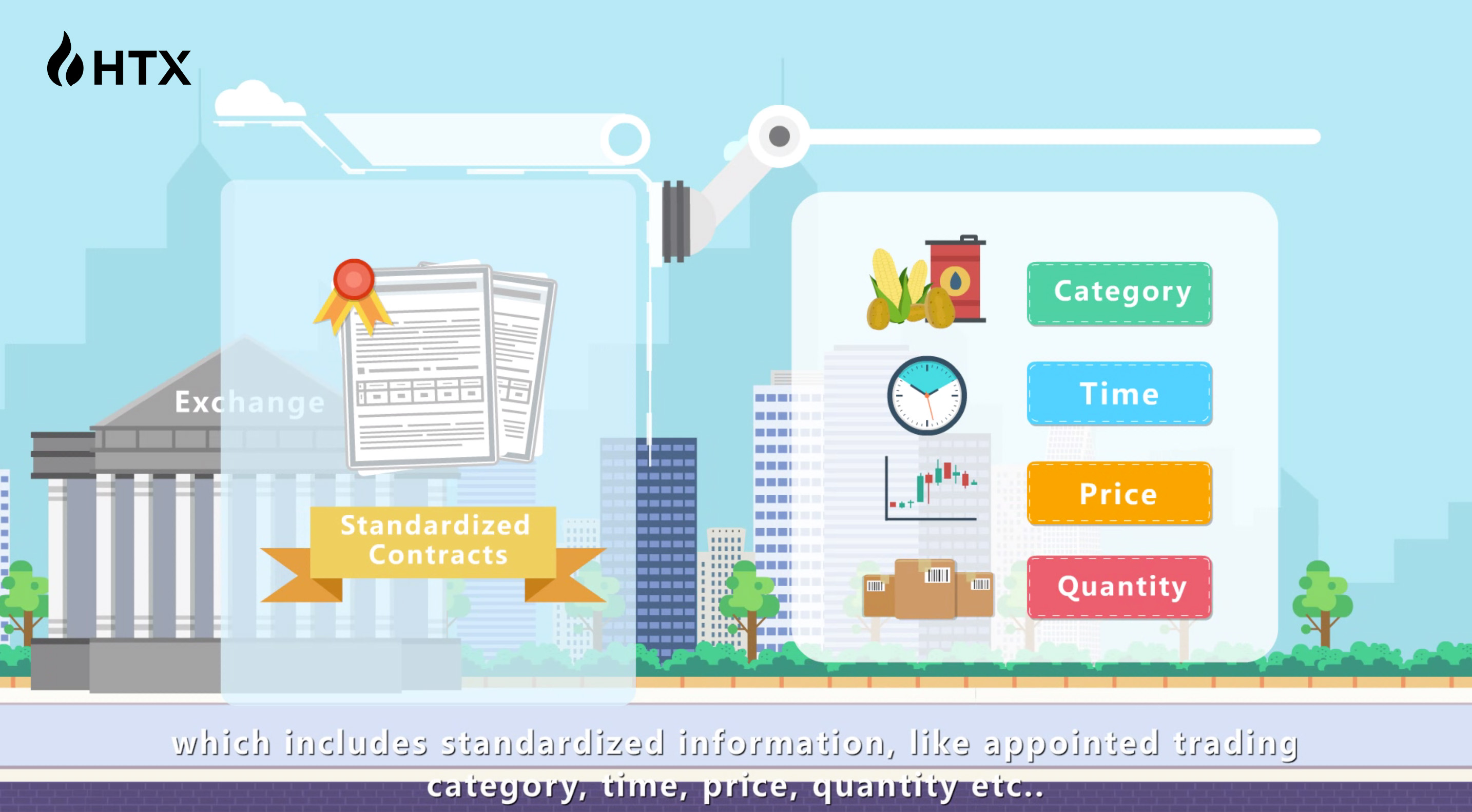

While, the underlying objects of contract trading are standardized contracts

which includes standardized information, like appointed trading category, time, price, quantity etc..

Second, the objects’ scopes are different.

Spot transaction deals with all the current commodities, however, contract trading focuses on physical commodities (such as agricultural products, energy resources, metal etc.), and several types of financial products(like stocks,bonds etc..).

Third, trading rules are different.

No matter how long the trading period is, spot transaction clears price once or several times as soon as the commodity received.

Unlike, contract trading has a future delivery.

Finally, trading purposes are different.

Spot transaction aims at acquiring or selling commodities’ ownership between two parties.

Besides delivering physical commodities.

Contract trading can also transfer the uncertain risks brought by price fluctuation of spot market, or take profit from the price fluctuation of contract market.