Options introduction

- Options guides

Options type

1. Call options

American call options entitle holders to buy the underlying assets at a specific price, quantity, and at a future time. HTX Options do not perform physical delivery, and call options holders may make a profit if the underlying assets appreciate. Moreover, holders can exercise their options in advance to lock in profits.

2. Put Options

American put options entitle holders to sell the underlying assets at a specific price, quantity, and at a future time. HTX Options do not perform physical delivery, and put options holders may make a profit if the underlying assets depreciate. Moreover, holders can exercise their options in advance to lock in profits.

Users can only BUY options -with leverage, low risk, and high yield

Users can only buy HTX Options. HTX Options feature leverage, low risk, and high yield. Options sellers bear higher risks, and users cannot sell (write) options for now.

1. Inherent leverage

American options give holders a right to profit from the price movement of underlying assets at a limited cost and at a future time.

Example: When the BTC price is $53679.85 and you buy an American option (1-day term) for 1 BTC, the required options premium is $1784.93. In this case, the leverage is 30 times.

The above example is for explanation only and cannot be used as an investment reference. The options premium is affected by real-time prices of underlying assets.

2. Controllable risk

When the market fluctuates sharply, spot leverage, perpetual contracts, and delivery contracts all have the risk of liquidation while options buyers do not. In fact, options buyers are only subject to limited losses as their maximum loss is only the options premium.

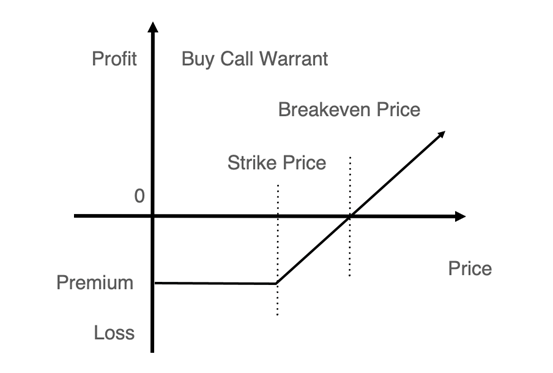

Yield curve for call options buyers

As shown in the figure, if the price of the underlying asset falls, the maximum loss of the call options buyer is only the premium.

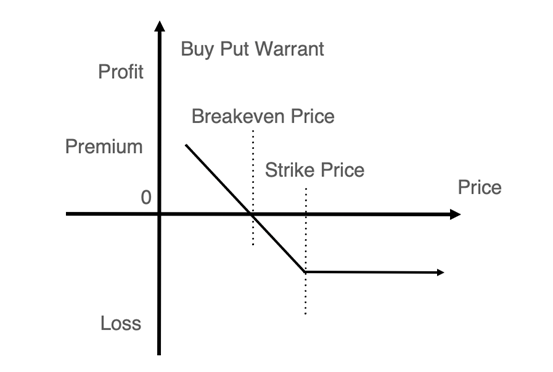

Yield curve for put options buyers

As shown in the figure, if the price of the underlying asset rises, the maximum loss of the put options buyer is only the premium.

3. High yield

In theory, call options buyers may have unlimited returns. Take call options as an example. If the underlying asset price rises sharply, the call options can reap the same return. Similarly, if a user purchases a put option, a sharp drop in the underlying asset price will bring the user the same magnitude of return.

Simple purchasing process-no need to set the exercise price or expiration date

For traditional exchange-traded options, the trading process is complicated, the same underlying asset has different expiration dates, and there are options contracts with different exercise prices on the same expiration date. For ordinary users, the threshold for exchange-traded options is too high and trading is too complicated. HTX Options (App) simplifies the options purchase process and lowers the threshold for users.

1. No need to set an exercise price

HTX Options (App) use the real-time price of underlying asset as the exercise price, and there is no need for users to set the exercise price. In other words, users buy at-the-money options (underlying asset price = exercise price) in HTX Options (App).

Take the call options as an example:

The user purchases a BTC call option contract in HTX Options (App), which is designed to purchase BTCs of the contract value at the BTC index price. If the BTC price rises, users can reap the benefits accordingly.

Take the put options as an example:

The user purchases a BTC put option contract in HTX Options (App), which is designed to sell BTCs of the contract value at the BTC index price. If the BTC price drops, users can reap the benefits accordingly.

2 . Rich choices of options terms

Users can directly select the options term below the underlying asset price, such as 5 minutes, 10 minutes, 1 day, 3 days, 1 week, etc. HTX Options (App) simplifies the choice of options terms.

Exercising

1. Exercise upon expiration

When a HTX option expires, it is exercised and settled at the real-time price of the underlying asset.

2. Exercise before expiration

HTX Options are American ones and users can exercise their options in advance to lock in profits.

HTX Options are settled in USDT and the underlying asset is not delivered.

For specific payment rules, please refer to >>>.

Application scenarios of HTX Options

1. Hedging

Users can use HTX Options to hedge risks. For example, if BTC holders are worried about price drops, they can use put options to reduce losses. Specifically, miners/BTC borrowers can use options to hedge BTC's downward risks and Defi users can use options to hedge impermanent losses.

2. Speculative trading

Speculative trading is possible with HTX Options. For example, a user can buy call options to bet on a BTC upward movement.

3. Short-term strategy

Unlike traditional options, HTX Options provide relatively short terms ranging from 5 minutes to 1 year. Users can buy such options to implement different short-term trading strategies.

E-Mall: [email protected]

Twitter:https://twitter.com/HTX_Options

Telegram:https://t.me/HTXOptions

Trade on the go with HTX’s mobile crypto trading app

Click here to download for iOS or Android

Find us on

Twitter:https://x.com/htx_global

Facebook:https://www.facebook.com/htxglobalofficial/

Instagram:https://www.instagram.com/htxglobalofficial/

Reddit:https://www.reddit.com/r/HuobiGlobal/

Medium:https://htxofficial.medium.com/

Telegram:

https://t.me/htxglobalofficial

HTX reserves the right in its sole discretion to amend or change or cancel this announcement at any time and for any reasons without prior notice.